Non-ferrous metallurgy is a completely separate part of heavy industry. Methods of extraction, processing and smelting of non-ferrous metals differ significantly from the methods of ferrous metallurgy. In economically developed countries, the ratio of production of non-ferrous and ferrous metals is approximately 15:85. The world's non-ferrous metallurgy is inferior to ferrous metallurgy in terms of the quantity of products produced, but in terms of cost it is hundreds of times higher.

Interesting fact . Every year, metallurgists spend more than 300 billion kilowatt-hours of electricity to smelt non-ferrous metals. This figure is comparable to the annual electricity consumption in India.

Non-ferrous metallurgy is one of the main engines of scientific and technological progress. Non-ferrous metal is the basis of all electrical engineering. Non-ferrous metals are the main raw materials for the construction of aircraft, sea vessels, weapons and ammunition, power plants, electrical infrastructure and so on.

It should be noted that the development trend of non-ferrous metallurgy has been observed only in the last 100 years. At the beginning of the 20th century, non-ferrous metal was produced in volumes of no more than 2 million tons per year. By the end of the 20th century, non-ferrous metallurgy was producing at least 45 million tons of metal annually.

Features of non-ferrous metallurgy

The non-ferrous metals market is characterized by a total monopoly. Manufacturers of raw materials from which final products are obtained can be counted on one hand:

- Alcoa (USA)

- Reynolds Metals (USA)

- Anaconda (USA)

- Asarco (USA)

- Alkan" (Canada)

- Pechinet Eugene Cuhlmann (France)

The production of finished products, as well as the sphere of their sales and many other branches of non-ferrous metallurgy are also subject to monopolization.

It is worth noting that the production of non-ferrous metals is characterized by a higher science intensity than the production of ferrous metals. For the most part, the process of processing ore raw materials is completely unique. Each deposit has its own special chemical composition of the ore. To obtain color, an individual scheme for processing ore raw materials is developed.

Non-ferrous metals market: resources, classification, investment prospects

Introduction

The metallurgical industry consists of ferrous and non-ferrous industries. They constitute a single functioning organism, are a basic industry for the economies of many countries and are characterized by high capital and material intensity. Today, as in ancient times, metal is the most important and basic material for humanity. In construction, mechanical engineering, manufacturing and development of microprocessor technologies, one cannot do without the use of various metal alloys, different in their composition and purpose. Non-ferrous metallurgy refers to heavy industry and includes the extraction and beneficiation of ore, production, processing and smelting of non-ferrous metals and their alloys (non-ferrous, rare or noble).

The industrial complex related to non-ferrous metallurgy consists of mining enterprises, processing plants, non-ferrous scrap processors, and metallurgical plants.

The raw material base of non-ferrous metallurgy has a number of important features: – non-ferrous metals are distinguished by the presence of various components in their composition. For example, some Ural metals are distinguished by a high content of copper, iron, silver, sulfur (the number of elements can exceed 30); – non-ferrous metals are characterized by high fuel and energy consumption during processing. Fuel capacity is typical for manufacturing - nickel, blister copper, alumina, and electrical capacity differs - aluminum, magnesium, titanium and calcium.

It is the knowledge of these features that makes it possible to locate non-ferrous metallurgy industries in regions supplied with electrical energy.

Functional characteristics of non-ferrous metallurgy

Non-ferrous metallurgy has the highest consumption of raw materials among industrial production. For processing, ore with a low content of valuable components (from 0.3–0.5 to 2.1%) is used. An exception is the processing of bauxite to produce aluminum. This industry has the most significant electricity and fuel consumption. Also, to ensure uninterrupted operation, non-ferrous metallurgy enterprises require a large number of labor resources, i.e. this industry is labor-intensive. Non-ferrous metal enterprises are mainly engaged in the processing of polymetallic ores. The industry consists of the extraction of ore raw materials, its enrichment, metallurgical processing, and further processing of the resulting metal. Completing all of the above stages is considered a full production cycle. Enterprises in the non-ferrous metallurgy industry are located geographically depending on the location of mineral resources. In this case, the natural resource factor is decisive.

Process of extracting metals from ore

Bauxite

Extracting metals from ore requires large amounts of energy and produces significant greenhouse gas emissions into the environment. Primary production involves the extraction of metals from ore, and secondary production involves the extraction of metals from scrap collection. For the secondary phase, an electric arc furnace is used, which consumes significantly less energy. This energy saving technology reduces the environmental impact. The transition to clean energy requires exponentially more metals and other materials to power batteries, electric vehicles, solar panels and wind turbines.

Will there be enough raw materials needed for an effective green transition? All economically developed countries are asking this question today.

The most popular non-ferrous metals

Aluminum, copper, zinc are important for the manufacturing industry, sustainability and economic growth of states. They are indispensable for the automotive, aerospace, engineering and construction industries. Their unique thermal, electrical and insulating properties, combined with endless recyclability and low weight, make them essential for achieving energy and resource efficiency goals. These metals are widely used due to their light weight (aluminium), high conductivity (copper), corrosion resistance and non-magnetic properties (zinc). The last two properties distinguish them from ferrous metals, for example, from steel. The aluminum industry plays a leading role in the global non-ferrous metallurgy. The bulk of ore reserves containing this valuable metal are concentrated in the equatorial zone.

However, successful aluminum production is only possible in countries that have large sources of inexpensive energy:

- Canada, Norway, Russia, Brazil and the USA have significant hydrological resources and powerful hydroelectric power stations;

- The Netherlands, UAE, Iraq, Great Britain are rich in natural gas;

- China, India, Australia - have large reserves of coal;

- In countries with expensive energy (Austria, Hungary, France), where aluminum smelting was considered a traditional type of industry, the production of this non-ferrous metal is gradually disappearing.

Based on physical properties and purpose, non-ferrous metals are divided into:

- light (magnesium, aluminum, titanium);

- heavy (tin, nickel, lead);

- noble (gold, silver, platinum);

- scattered;

- refractory;

- rare earth;

- radioactive.

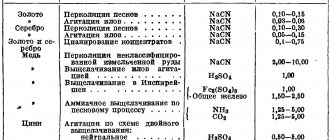

Ores containing copper, nickel, lead - about 1%, tin - less than 1% are considered industrial. For example, to obtain 1 ton of copper, 100 tons of ore are required, 1 ton of tin requires 300 tons of ore. The location of non-ferrous metallurgy enterprises is influenced by many natural and economic factors, among which the raw material factor plays a special role. Ores of heavy non-ferrous metals differ from light ores with low metal content. Another feature of heavy non-ferrous metal ores is their complexity. Copper, tin, lead-zinc ores contain dozens of other metals and sulfur. Therefore, integrated production of raw materials is of great importance. Thus, at the Norilsk Copper-Nickel Combine, in addition to nickel, copper and cobalt, more than ten other types of products are produced. Of particular interest is the combination of heavy non-ferrous metals metallurgy and basic chemistry, for example, the use of sulfur dioxide in the production of zinc and copper. Even more complex territorial combinations of different industries arise in the production of light non-ferrous metals. Thus, with the complex processing of nephelines (from this type of raw material alumina is obtained, and then aluminum), potash and cement (i.e., they are combined with chemical industry enterprises and the production of building materials). The importance of the precious metal - gold, in terms of reserves of which Russia ranks third in the world (and in the production of which the country has dropped from second to sixth place). According to official data, South Africa extracts 583 tons of gold from its subsoil, and Russia – just over 100 tons. Deposits of this metal are concentrated in Siberia and the Far East. Silver is obtained by refining heavy metals. It is used in the manufacture of jewelry and in industry. Without silver, for example, it is impossible to make film and photographic films.

Non-ferrous metals market overview

- Due to growing demand for resources from rapidly developing countries in Asia, global production and international traffic of both raw ore and its enrichment products, concentrates, have increased. The concentration of countries producing and consuming raw materials has also increased.

- Since the beginning of the 21st century. The raw material base of non-ferrous metallurgy has followed a new vector of development. If in 1985-2000. global production of raw materials for non-ferrous metallurgy increased by 44% (from 35.3 million tons to 50.0 million tons), then in 2000-2019. the growth was 109% (from 50.0 million tons to 104.3 million tons).

- This boom was caused by an unprecedented increase in demand for minerals and metals from China, India, and South Korea.

- More than 70 metals are extracted from the raw materials complex of non-ferrous metallurgy. But in 2022, 99% of all global production came from four metals - aluminum, copper, zinc, lead.

- The share of primary aluminum was 62%, copper – 20%, zinc – 12%, lead – 5%. At the same time, the share of production of primary aluminum and copper tends to gradually increase against the background of a decrease in the production of zinc and lead.

- The development of new industries required the use of new materials. In particular, the increase in demand for electric vehicles has caused a sharp increase in the need for raw materials for batteries. The widespread use of mobile devices and laptops has required the use of high-quality batteries. The key materials in the technologies for creating various batteries are: lithium, cobalt, nickel, cadmium, graphite.

- Gallium has found wide application in microelectronics, medical equipment, and in the production of electric lamps

- During the period 2000-2018. lithium production increased by 596%, gallium - by 521%, cobalt - by 265%.

- In 2022, six countries were leading in the global raw materials complex of non-ferrous metallurgy: China – it accounted for 43% of the gross production of non-ferrous metals (or 32% in value terms), Russia, Australia, Chile, Peru, Canada.

Distinctive features of non-ferrous metallurgy:

– increasing the production of zinc and lead through recycling; – global unevenness and inequality of industrial development demonstrate that mining, primary processing, on the one hand, and final production, use of metal, on the other, are carried out in different countries; – foreign trade turnover of raw materials of non-ferrous metallurgy is comparable in physical volume to production. Thus, in 2022, out of 370 million tons of mined aluminum ores, world exports (in the form of ores and concentrates) amounted to 132.1 million tons, out of 20 million tons of mined copper, 36.6 million tons were exported in the form of copper ores and concentrates, from 13 million tons of zinc - 11.9 million tons, of 4.5 million tons of lead - 3.5 million tons of ores and concentrates.

Impact of the pandemic on the industry

Copper: market balance, 2016-2023

The situation on the global non-ferrous metals market during the pandemic and post-pandemic period turned out to be ambiguous. Megatrends expects the global copper market to remain tight through 2023 as growth in demand for the metal continues to outpace production capacity development. The price of copper in the period from 2019 to 2023 will be fixed in the region of 5,900–6,300 dollars/t.

Nickel: market balance, 2016-2023

On the one hand, like the ferrous metals market, the non-ferrous metals market, starting from the second half of 2022, was in an unstable state and was characterized by a fall in prices for base metals (nickel, copper, zinc, aluminum, etc.).

According to Megatrends estimates, in 2022 the nickel market will see a surplus for the first time in many years, which is primarily due to an increase in metal production from Russian ore, as well as the launch of projects in Indonesia, Brazil and the restoration of production in the Philippines. Due to the increase in surplus to 300 thousand tons, we expect nickel prices in 2019–2023 to be in the range of $12,100–13,000/t.

Zinc: market balance, 2016-2023

The shortage in the zinc market will last until 2023, which is due to insufficient investment in metal mining and exploration in 2009–2017. However, it is worth noting that the global deficit will no longer contribute to rising prices, since their significant rise in 2016–2018 is largely explained by speculative rather than fundamental factors, the influence of which has faded. The ongoing zinc mining projects in South Africa (Gamsberg mine - 250 thousand tons per year) and Iran (Mehdiabad mine - 400 thousand tons) in the future will reduce the deficit in the market. In this regard, we expect zinc prices to decline in 2019–2023 to $2,200–2,500/t.

It should be noted that the impact of the pandemic was multi-vector in individual markets. Thus, the decline in the aluminum market continued, since even the recovery of business activity in China, which began earlier than in the rest of the world, did not have a positive impact due to the fact that the country is a net exporter of this metal. In addition, during the pandemic, car sales and production have decreased significantly, and the automotive industry is one of the key consumers of this metal. The oversupply of aluminum caused its prices to continue to fall.

Aluminum: market balance, 2016-2023

Note: Rising aluminum prices in 2018 allowed a large number of producers, including in China, which accounts for half of the world's capacity, to increase production of the metal. Total global aluminum production reached 64.4 million tonnes in 2022, resulting in an oversupply that will continue until 2022. However, in 2022-2023 the situation will be reversed against the backdrop of rapid growth in global metal consumption. According to Megatrnds, among the potential risks for the market is the possibility of new sanctions against UC Rusal, which could significantly affect the level of global aluminum supply.

The opposite “pandemic” vector was observed in the gold market due to its investment attractiveness. During periods of heightened economic uncertainty, gold was in high demand, providing a more stable alternative to other investment assets. Instability in financial markets due to negative changes in the global economy led to difficulties in the foreign exchange and stock markets, and therefore, even from central banks, the demand for physical gold increased.

Gold: market balance, 2012-2020

Challenges facing the sector

Important issues affecting the competitiveness of the non-ferrous metals industry include climate change, environmental protection, energy costs, access to raw materials, research, innovation and trade.

- Energy: Non-ferrous metals production is very energy intensive, and high energy prices discourage investment in primary production. The lack of production is partially compensated by an increase in the use of secondary raw materials and an increase in imports. Partnership: access to raw materials - dependent on high demand and policy measures in individual countries. Thus, the issue of raw materials in the EU is considered in a special act adopted in November 2008 on the European Innovation Partnership.

- Government support: Trade measures implemented by individual countries often benefit from government support.

- Low flexibility: The industry is highly capital intensive and has low flexibility. The main factors in investment decisions made by metal producers are access to raw materials and energy at competitive prices, as well as proximity to end consumers.

- Incentives: Manufacturing location – the proximity and size of process industries remains the biggest incentive to maintain an industry. At the same time, relocating production to countries with lower energy prices and low social and environmental costs challenges the status quo around the world.

- Innovation: The future of the non-ferrous metals sector will depend on innovation, improving product quality, finding niche markets and new products to meet demand, such as exploiting the antiseptic properties of copper or new advanced alloys for wires.

- Price: The cyclical nature of commodity prices, driven by global supply and demand, also impacts the base metals sector. Most non-ferrous metals are traded on the world market and their prices are set by the London Metal Exchange (LME). This pricing mechanism limits the ability of nonferrous metal producers and processors to pass on costs to customers.

Megatrends analysts' opinion

In conclusion, we emphasize that, unlike many other industries, non-ferrous metallurgy, like ferrous metals, was in a pre-crisis state, starting in the second half of 2022, which was reflected in a fall in prices for base metals. As a result, the impact of the pandemic, although significant, did not have a dramatic negative impact on the industry and, moreover, contributed to its recovery during the recovery of global business activity after the peaks of the pandemic had passed. On the one hand, the main indicators of the ferrous and non-ferrous metals markets - production, consumption and prices - have been showing steady growth since the second half of 2020. On the other hand, the impact of the pandemic on the organization of business processes and operations has led to significant changes in the management systems of companies engaged in the metallurgy industries, which in the long term will lead to an increase in their efficiency, adaptation to the realities of the modern world, which were previously hampered by the traditional conservatism of the industry . Thus, in general, we can talk about the revitalizing impact of the pandemic on the global non-ferrous metals markets. We plan to continue publishing materials on the non-ferrous metallurgy industry and its investment attractiveness in future posts. Therefore, if you want to make money in the industry, all you have to do is follow our news on the website or in the telegram channel and be ready to diversify your portfolio. If you want to be the first to receive our analytics, then you just need to subscribe to the newsletter.

The main problems of non-ferrous metallurgy

The non-ferrous metallurgy industry is not without its pitfalls. The main factors that slow down the development of the industry are:

- Environmental pollution

- High power consumption

- Low concentration of metals in ore

Regarding ecology, the main damage to the natural environment is caused in the process of recycling heavy metals. Nickel, magnesium, lead and tin. All these substances poison the environment, ending up in spontaneous landfills and solid waste landfills.

Most non-ferrous metals belong to the refractory category. The production of ready-to-sell products requires approximately 5 times more electricity than the production of ferrous products.

The raw material for producing flowering plants is highly dispersed in the ground. As practice shows, the concentration of non-ferrous metals in ore rarely exceeds 1.5-3%. The record concentration that was recorded is 8%.

Leading countries in gold production

Every year about 2500-2900 tons of gold are mined in the world, the total amount of precious metal mined is more than 190,000 tons.

Leading countries in gold mining:

- People's Republic of China - 12.9% (about 300 tons of precious metal are extracted from the depths of China and the country's indicators are growing every year).

- African countries - 9% (250-260 tons of gold are mined per year in the territory of the Republic of South Africa).

- Australia – 9.5% of the total world volume, (220-230 tons). Small deposits can be found in all states of the state, the largest are located in the Eastern and Northern parts of the country-continent.

- USA – 8.9% (230 tons per year). Deposits are discovered annually in almost all regions. Gold in the USA is mined exclusively using closed methods.

- Russia – 8%.

Statistics are based on the amount of gold mined by states each year. The statistics of state natural resources and gold deposits are as follows:

- South Africa – 19%

- USA – 13%

- Australia – 12%

- Russia – 7%

- Indonesia – 4%

The Republic of Kazakhstan ranks 10th in the world in terms of explored gold deposits, 3rd in the CIS and deservedly ranks among the leading countries in the production of non-ferrous metals.

Mining of precious metals in Kazakhstan is a profitable and promising direction. More than 190 deposits of gold, silver and diamonds are known on the territory of the republic, the main part of which is located in the southern, central and eastern parts of the state. Significant natural reserves and the number of undiscovered deposits make investments in demand in the exploration, production and export of metal from Kazakhstan.

Iron

Let's start with the most common metal - iron, known to man for many millennia, without which we will not be able to do without for a very long time.

Currently, geologists know deposits that will provide us with iron for 250 years, and there is no doubt that new reserves will be discovered. Of course, it is a widely used metal, but it should be noted that its production, like the production of other metals, is much cheaper when recycled materials (that is, scrap metal) are also used.

Copper

For example, copper: in 1925, an ore was considered to be a rock that contained an average of 2.5% copper. It was profitable to mine it, produce copper from it and sell the metal. Somewhat later, ores with a lower copper content began to be mined, since as industry developed and the use of electricity increased, the consumption of this material also increased.

Currently, the world's average mined rocks contain 0.7% copper, as copper consumption has increased many fold and continues to do so. The price rises accordingly. In order to obtain a ton of metal from rich ore (2.5%), it is necessary to expend a certain amount of energy, and in order to obtain the same amount from poor ore (0.7%), three times more energy is needed. In addition, when using low-grade ores, it is necessary to move a colossal amount of material, build a new transport network, and use giant vehicles with high fuel consumption. Copper ore mining leaves environmental consequences in nature.